Who We Are ?

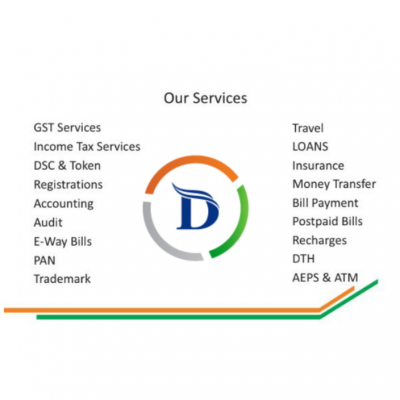

We are Dim Office in Daltonganj providing Professional Business Services to our client. Backed up with over 100+ accounts executives, we provide end to end business solutions when it comes to GST, Registration, ITR, Insurance, Loans & B2C services like Tours & Travel, Bill payments, recharges, money withdrawal & recharges etc.

For more information about our services, please click here

You can contact us on :

Info@dimoffice.in officialdim01@gmail.com

Sahitya Samaj Chowk, Daltonganj , Palamau , 822101, Jharkhand

What we do ?

Good And Service Tax

- GST Registration

- GST (Nil) Return /Regular Filing Regular Scheme (GSTR1/GSTR3B)

- GSTR Return Filing Composition Scheme (GSTR-4)

- (GSTR 8)/(GSTR 9/9A)/(GSTR 10)

- GST Reconciliation (Upto 3 Months)

- GST CASH REFUND /Surrender

- GST Audit/Response of Notice

- All GST Services.

INCOME TAX RETURN

- ITR For Salaried Person / 1 House Property / Other Source/ ITR-1

- ITR (Capital Gain/ House Property / Other Source) / ITR-2

- ITR (Proprietor Business) / ITR-3

- ITR-4/ITR-5

- CA Certification of ITR

- ITR Form 10E /Response of Notice/ Correction

We provide all types of Income Tax Return Services for current year, previous years and all types of Amendments.

DSC (DIGITAL SIGNATURE CERTIFICATE)

- DSC Class-2/2 Years/ Signature

- DSC Class-2/2 Years/ Combo for Individuals

- DSC Class-2/2 Years/ Combo for Organizations

- DSC Class-2/2 Years/ Govt. Combo (DGFT)

- DSC Class-3 /2 Years/ Combo

- DSC Class-3 /2 Years / Govt. Combo (DGFT)

- DSC Class-3 /2 Years / Signature for Individuals

- DSC Class-3 /2 Years / Signature Organizations

- DSC Token

REGISTRATION

- Udyog Aadhar Registration (MSME)

- FSSAI Licence/FSSAI Registration

- Gem Registration

- Registration Under Shop & Establishment Act

- LLP /Partnership/Proprietorship Registration

- Director Identification Number (DIN)

- Tax Deduction Account (TAN) Registration

- Conversion of the Company

- Nidhi Company Registration

- Section 8/ OPC Registration

Accounting

- Balance Sheet & Profit Loss Account

- CA Certification of Balance Sheet

- Accounting Package (Monthly/Yearly)

- GST Book keeping (Monthly/Yearly)

- Digital Tax Payment (Monthly/Yearly)

There are more than 20 types of accounting services provided by GST Suvidha Kendra. We can also provide you door step services to save your time.

AUDITS

- Appointment of an Auditor 1 (Form ADT-1)

- Income Tax Audit (Upto 1 Crore)

- Appointment of an Auditor 1 (Form ADT-1)

- Income Tax Audit (Above 1 Crore Upto 2 Crore)

- Income Tax Audit (Above 2 Crore Upto 5 Crore)

- Income Tax Audit (Above 5 Crore Upto 10 Crore)

IEC – IMPORT/EXPORT CODE

- Import Export Code (IEC) AMMENDMENT

- Import Export Code (IEC) Registration Including Govt Fees.(Company)

- Import Export Code (IEC) Registration Including Govt Fees.(Partnership)

- Import Export Code (IEC) Registration Including Govt Fees.(Proprietorship)

We Know Import and Export of any product need lots of verification & drafting. All of your hard work should be taken care by a team of professionals. So, we are here to provide you the necessary support.

INTELLECTUAL PROPERTIES

- Trademark Registration – Individual (Gov. Fee)

- Trademark Registration – Other Than Individual (Gov. Fee)

- Trademark Registration – Processing Fee

This is one of the important tasks. From Drafting to publishing, there are so many stages involved. We take care of your trademark application by providing right category whether it is a name or logo.

E-WAY BILLS

- E-way – (Pack -100) – Quarterly

- E-way – (Pack -15) – Monthly

- E-way – (Pack -5) – Monthly

- E-way Bill – Registration

- E-way Bill- Single

This can be a headache when you are new to E-Way Bills. For all the bills which are more than 50,000 Rupees, E-Way bill is mandatory. With our flexible plans, you can relax and order the E-way bill online.

MISCELLANEOUS SERVICES

- TDS challan Submission

- TDS Return (Quarter filing) for Individual

- TDS Return (Quarter filing) for Organization

- ADVANCE TAX

- CMA Report

- ROC E FILING

- Alteration/Addition in Company

- Letter of Undertaking (LUT) File

- Name Change of Company

- Name Approval of LLP, Private Limited, OPC(RUN Form)

- DIR-3 KYC

- Company KYC (Active Form) INC-22

- Surrender of DIN

- Declaration of Commencement of Business

- Change in Director Details

- Closing of Company-(Excluding Govt. Fees)

PAN CARD

- New PAN Card

- Correction Application

- Duplicate Application

We at GST Suvidha Kendra provide information about Pan Card and assistance to Individuals in applying for the same through the authorised agents of the authorities. The services rendered include verifying, supporting and filing the application forms for those who are applying for new PAN card, corrections and changes to their existing PAN data and request for duplicate or replacement of lost or damaged PAN card.

INSURANCE SERVICES

- Car Insurance (1st & 3rd Party)

- Two-Wheeler Insurance (1st & 3rd Party)

- Health Insurance

- Term Insurance

- Travel Insurance

- Critical Insurance

- Child Insurance

- Investment

- Pension

LOAN SERVICES

- Personal loans

- Business loans

- Loan Against property

- Home loans

- Vehicle loans

With our Loan services, you can check your eligiblity before applying for a loan & save your time. Our system do this check within 10 minutes. Once approved, you can avail loans very fast.

WEBSITE & LOCAL MARKETING SERVICES

- 1 Page Website + Domain + Hosting + 1 Business Email + Logo

- E-Commerce Website + Domain + Hosting + 1 Business Email + Logo + 20 Pages

- SSL ( Security for Websites)/Logo Design /

- Brochure / Pamphlet / Visiting Card

- Listing in 10 Local Websites

- City Wise SEO Promotion

- Google Ads Set-Up

- Facebook Ads Set-Up

- Social Media Pages Creation

AEPS -( AADHAAR ENABLED PAYMENT SYSTEMS )

- Withdrawal of cash

- Balance Inquiry

- Deposition of the amount

- Acquiring mini bank statement

- Transferal of funds from one Aadhaar-linked bank account to another Aadhaar-linked accounts

No need to go to the bank when you need cash. Simply, apply for your finger and withdraw the money from us.

MONEY TRANSFER SERVICES

- GSK, first of all add the Beneficiary with Name, IFSC, Account Number & mobile number.

- The mobile number gets verified with OTP.

- Once, added, Money transfer can be done up to 25,000 Rs in one single transaction.

- In a single day, you can transfer up to 1 Lakh rupees in multiple transaction .

- You can also do RTGS/NEFT/UPI also for the current accounts.

BILL PAYMENTS

- Mobile Post-Paid Bill Payment

- Electricity Bill Payment

- Landline Bill Payment

- Data card Bill Payment

- Cable TV Bill Payment

- DTH Bill Payment

- Piped GAS Bill Payment

- Broadband Bill Payment

- Insurance Premium Payment

- Water Bill Payment

Recharges

- Pre-Paid Mobile / Data Card

- Airtel / BSNL / IDEA / JIO / MTNL / VODAFONE

- DTH Recharges

- Airtel DTH Recharge

- Dish TV Recharge

- Tata Sky Recharge

- Sun Direct Recharge

- Videocon D2H Recharge

TOURS & TRAVELS

- FLIGHT (DOMESTIC)

- FLIGHT ( INTERNATIONAL)

- HOTEL BOOKING ( DOMESTIC)

- HOTEL BOOKING ( INTERNATIONAL )

- BUS BOOKING

- TRAIN BOOKING

Good And Service Tax

- GST Registration

- GST (Nil) Return /Regular Filing Regular Scheme (GSTR1/GSTR3B)

- GSTR Return Filing Composition Scheme (GSTR-4)

- (GSTR 8)/(GSTR 9/9A)/(GSTR 10)

- GST Reconciliation (Upto 3 Months)

- GST CASH REFUND /Surrender

- GST Audit/Response of Notice

- All GST Services.

INCOME TAX RETURN

- ITR For Salaried Person / 1 House Property / Other Source/ ITR-1

- ITR (Capital Gain/ House Property / Other Source) / ITR-2

- ITR (Proprietor Business) / ITR-3

- ITR-4/ITR-5

- CA Certification of ITR

- ITR Form 10E /Response of Notice/ Correction

We provide all types of Income Tax Return Services for current year, previous years and all types of Amendments.

DSC (DIGITAL SIGNATURE CERTIFICATE)

- DSC Class-2/2 Years/ Signature

- DSC Class-2/2 Years/ Combo for Individuals

- DSC Class-2/2 Years/ Combo for Organizations

- DSC Class-2/2 Years/ Govt. Combo (DGFT)

- DSC Class-3 /2 Years/ Combo

- DSC Class-3 /2 Years / Govt. Combo (DGFT)

- DSC Class-3 /2 Years / Signature for Individuals

- DSC Class-3 /2 Years / Signature Organizations

- DSC Token

REGISTRATION

- Udyog Aadhar Registration (MSME)

- FSSAI Licence/FSSAI Registration

- Gem Registration

- Registration Under Shop & Establishment Act

- LLP /Partnership/Proprietorship Registration

- Director Identification Number (DIN)

- Tax Deduction Account (TAN) Registration

- Conversion of the Company

- Nidhi Company Registration

- Section 8/ OPC Registration

Accounting

- Balance Sheet & Profit Loss Account

- CA Certification of Balance Sheet

- Accounting Package (Monthly/Yearly)

- GST Book keeping (Monthly/Yearly)

- Digital Tax Payment (Monthly/Yearly)

There are more than 20 types of accounting services provided by GST Suvidha Kendra. We can also provide you door step services to save your time.

AUDITS

- Appointment of an Auditor 1 (Form ADT-1)

- Income Tax Audit (Upto 1 Crore)

- Appointment of an Auditor 1 (Form ADT-1)

- Income Tax Audit (Above 1 Crore Upto 2 Crore)

- Income Tax Audit (Above 2 Crore Upto 5 Crore)

- Income Tax Audit (Above 5 Crore Upto 10 Crore)

IEC – IMPORT/EXPORT CODE

- Import Export Code (IEC) AMMENDMENT

- Import Export Code (IEC) Registration Including Govt Fees.(Company)

- Import Export Code (IEC) Registration Including Govt Fees.(Partnership)

- Import Export Code (IEC) Registration Including Govt Fees.(Proprietorship)

We Know Import and Export of any product need lots of verification & drafting. All of your hard work should be taken care by a team of professionals. So, we are here to provide you the necessary support.

INTELLECTUAL PROPERTIES

- Trademark Registration – Individual (Gov. Fee)

- Trademark Registration – Other Than Individual (Gov. Fee)

- Trademark Registration – Processing Fee

This is one of the important tasks. From Drafting to publishing, there are so many stages involved. We take care of your trademark application by providing right category whether it is a name or logo.

E-WAY BILLS

- E-way – (Pack -100) – Quarterly

- E-way – (Pack -15) – Monthly

- E-way – (Pack -5) – Monthly

- E-way Bill – Registration

- E-way Bill- Single

This can be a headache when you are new to E-Way Bills. For all the bills which are more than 50,000 Rupees, E-Way bill is mandatory. With our flexible plans, you can relax and order the E-way bill online.

MISCELLANEOUS SERVICES

- TDS challan Submission

- TDS Return (Quarter filing) for Individual

- TDS Return (Quarter filing) for Organization

- ADVANCE TAX

- CMA Report

- ROC E FILING

- Alteration/Addition in Company

- Letter of Undertaking (LUT) File

- Name Change of Company

- Name Approval of LLP, Private Limited, OPC(RUN Form)

- DIR-3 KYC

- Company KYC (Active Form) INC-22

- Surrender of DIN

- Declaration of Commencement of Business

- Change in Director Details

- Closing of Company-(Excluding Govt. Fees)

PAN CARD

- New PAN Card 107 Rs inclusive GST

- Correction Application 107 Rs inclusive GST

- Duplicate Application

We at GST Suvidha Kendra provide information about Pan Card and assistance to Individuals in applying for the same through the authorised agents of the authorities. The services rendered include verifying, supporting and filing the application forms for those who are applying for new PAN card, corrections and changes to their existing PAN data and request for duplicate or replacement of lost or damaged PAN card.

INSURANCE SERVICES

- Car Insurance (1st & 3rd Party)

- Two-Wheeler Insurance (1st & 3rd Party)

- Health Insurance

- Term Insurance

- Travel Insurance

- Critical Insurance

- Child Insurance

- Investment

- Pension

LOAN SERVICES

- Personal loans

- Business loans

- Loan Against property

- Home loans

- Vehicle loans

With our Loan services, you can check your eligiblity before applying for a loan & save your time. Our system do this check within 10 minutes. Once approved, you can avail loans very fast.

WEBSITE & LOCAL MARKETING SERVICES

- 1 Page Website + Domain + Hosting + 1 Business Email + Logo

- E-Commerce Website + Domain + Hosting + 1 Business Email + Logo + 20 Pages

- SSL ( Security for Websites)/Logo Design /

- Brochure / Pamphlet / Visiting Card

- Listing in 10 Local Websites

- City Wise SEO Promotion

- Google Ads Set-Up

- Facebook Ads Set-Up

- Social Media Pages Creation

AEPS -( AADHAAR ENABLED PAYMENT SYSTEMS )

- Withdrawal of cash

- Balance Inquiry

- Deposition of the amount

- Acquiring mini bank statement

- Transferal of funds from one Aadhaar-linked bank account to another Aadhaar-linked accounts

No need to go to the bank when you need cash. Simply, apply for your finger and withdraw the money from us.

MONEY TRANSFER SERVICES

- GSK, first of all add the Beneficiary with Name, IFSC, Account Number & mobile number.

- The mobile number gets verified with OTP.

- Once, added, Money transfer can be done up to 25,000 Rs in one single transaction.

- In a single day, you can transfer up to 1 Lakh rupees in multiple transaction .

- You can also do RTGS/NEFT/UPI also for the current accounts.

BILL PAYMENTS

- Mobile Post-Paid Bill Payment

- Electricity Bill Payment

- Landline Bill Payment

- Data card Bill Payment

- Cable TV Bill Payment

- DTH Bill Payment

- Piped GAS Bill Payment

- Broadband Bill Payment

- Insurance Premium Payment

- Water Bill Payment

Recharges

- Pre-Paid Mobile / Data Card

- Airtel / BSNL / IDEA / JIO / MTNL / VODAFONE

- DTH Recharges

- Airtel DTH Recharge

- Dish TV Recharge

- Tata Sky Recharge

- Sun Direct Recharge

- Videocon D2H Recharge

TOURS & TRAVELS

- FLIGHT (DOMESTIC)

- FLIGHT ( INTERNATIONAL)

- HOTEL BOOKING ( DOMESTIC)

- HOTEL BOOKING ( INTERNATIONAL )

- BUS BOOKING

- TRAIN BOOKING