-

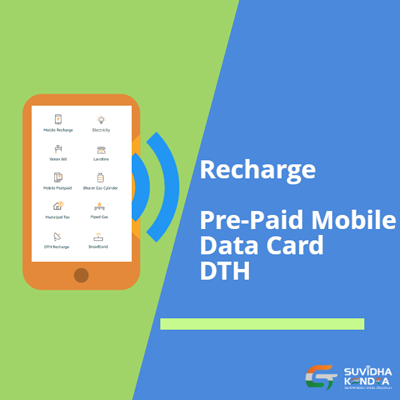

Recharges are costs that your business incurs when supplying goods and services to your customers. It's standard accounting practice to add VAT on to a recharged expense. Examples of a recharged expense: Airline tickets that you buy to visit a client or to travel to a job.

Recharges are costs that your business incurs when supplying goods and services to your customers. It's standard accounting practice to add VAT on to a recharged expense. Examples of a recharged expense: Airline tickets that you buy to visit a client or to travel to a job. -

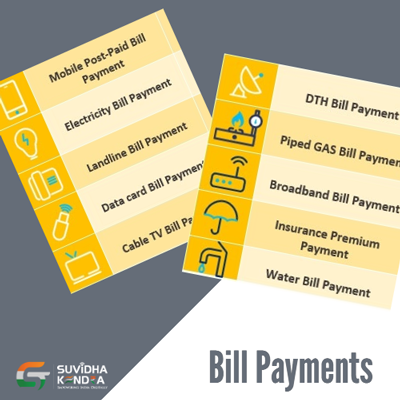

Bill payment is a facility provided to the customer to make their utility payments online through digital banking. The customer has different utility payments like Electricity Bill payment, Mobile bill payments, Water bill payments, insurance payments, etc.

Bill payment is a facility provided to the customer to make their utility payments online through digital banking. The customer has different utility payments like Electricity Bill payment, Mobile bill payments, Water bill payments, insurance payments, etc. -

Domestic Money Transfer is a service that is provided by numerous companies to transfer money from one account to another in any part of the country. ... The person who wants to send the money would have to deposit the amount to the DMR agent.

Domestic Money Transfer is a service that is provided by numerous companies to transfer money from one account to another in any part of the country. ... The person who wants to send the money would have to deposit the amount to the DMR agent. -

AEPS is a bank led model which allows online interoperable financial transaction at PoS (Point of Sale / Micro ATM) through the Business Correspondent (BC)/Bank Mitra of any bank using the Aadhaar authentication.

AEPS is a bank led model which allows online interoperable financial transaction at PoS (Point of Sale / Micro ATM) through the Business Correspondent (BC)/Bank Mitra of any bank using the Aadhaar authentication. -

-

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing and reporting these transactions to oversight agencies, regulators and tax collection entities.

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing and reporting these transactions to oversight agencies, regulators and tax collection entities. -

Digital Signature Certificates (DSC) are the digital equivalent (that is electronic format) of physical or paper certificates. ... Certificates serve as proof of identity of an individual for a certain purpose; for example, a driver's license identifies someone who can legally drive in a particular country.

Digital Signature Certificates (DSC) are the digital equivalent (that is electronic format) of physical or paper certificates. ... Certificates serve as proof of identity of an individual for a certain purpose; for example, a driver's license identifies someone who can legally drive in a particular country. -

A PAN card is a unique identification mark allotted by the IT department to all taxpayers in India. A PAN card displays the PAN number, a ten-digit alphanumeric code that helps the authorities keep a record of the financial activities of an individual across all platforms.

A PAN card is a unique identification mark allotted by the IT department to all taxpayers in India. A PAN card displays the PAN number, a ten-digit alphanumeric code that helps the authorities keep a record of the financial activities of an individual across all platforms. -

E-Way Bill is the short form of Electronic Way Bill. It is a unique document/bill, which is electronically generated for the specific consignment/movement of goods from one place to another, either inter-state or intra-state and of value more than INR 50,000, required under the current GST regime.

E-Way Bill is the short form of Electronic Way Bill. It is a unique document/bill, which is electronically generated for the specific consignment/movement of goods from one place to another, either inter-state or intra-state and of value more than INR 50,000, required under the current GST regime.